14 December 2009

25 May 2007

current events

2 Comments - Show Original Post Collapse comments

- Pradeep Bonde said...

-

When is the trend of your post going to go up?

May 24, 2007 3:44 PM

- walter said...

-

Pradeep,

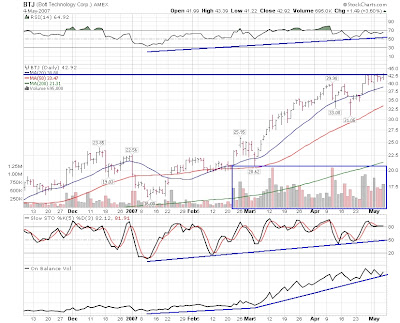

I've been "retooling" so to speak. In my trading (and I may have alluded to this in some of my comments on your blog) I have been struggling with trade execution - that is, the actual buying and selling of positions. Charting and trend line and price and volume analysis appealed to me on many levels (especially an aesthetic level) and they produced pretty pictures, but the resulting lines and understanding gained didn't and hasn't necessarily translated into a plan, at least for me, about getting into a position, having it go my way, and then getting out with profit. That being said, reading your blog and applying some charting analysis that has proved useful has inspired me to dabble with going long, and it has been going well so far. I see the logic and power in your double trouble and EP identification methods. There is no need for someone like me to reinvent the wheel. The art and challenge for me then comes into designing methods for piciing the which stocks to enter positions, when and how to enter those positions, and when to exit those positions. That's what i have been working on. And so I hav e been taking a break from this, but i am not abandoning it.

Thanks for asking!May 24, 2007 4:01 PM

06 May 2007

03 May 2007

MOV - setting up for short?

02 May 2007

i've been tagged

a) my five obsessions

- home renovation perfection - the tile grout's got to be just right, etc

- maximizing the mpg of my toyota prius

- researching compact digital cameras online with kickass wide angle lens features that i will probably never buy

- eliminating the clutter from my life

- staying current with current events

- document my ideas

- hopefully solicit good advice from readers

- develop and refine design and information presentation aesthetics

- creative outlet

- vanity